Other pages about the topic: Statewide data

2010–2024

| |

Population |

| 2010 Population |

6,724,540 |

| Plus Births |

1,204,335 |

| Less Deaths |

-804,477 |

| Plus Net Migration |

911,302 |

|

2022

2022

2022

2022

2022

2022

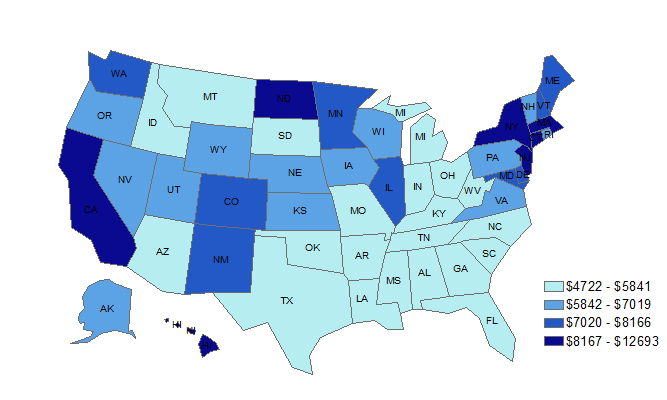

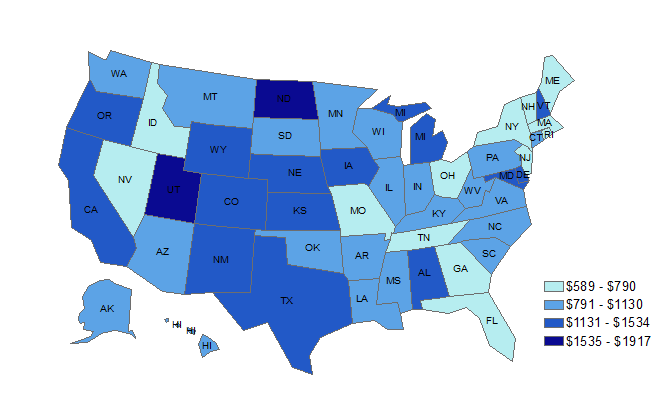

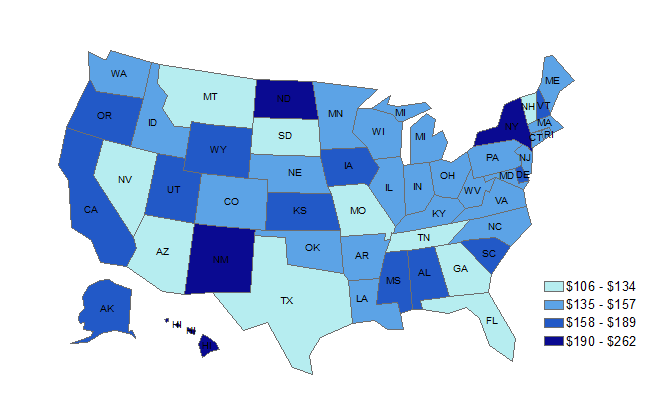

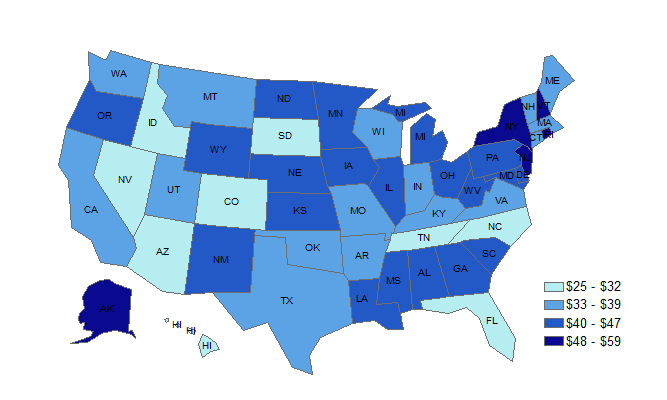

Washington state & local government expenditures, Fiscal Year 2022

($ millions)

Pages